2021 Office Market Recap

CURT ARTHUR, SIOR

OFFICE MARKET | SVN COMMERCIAL ADVISORS LLC

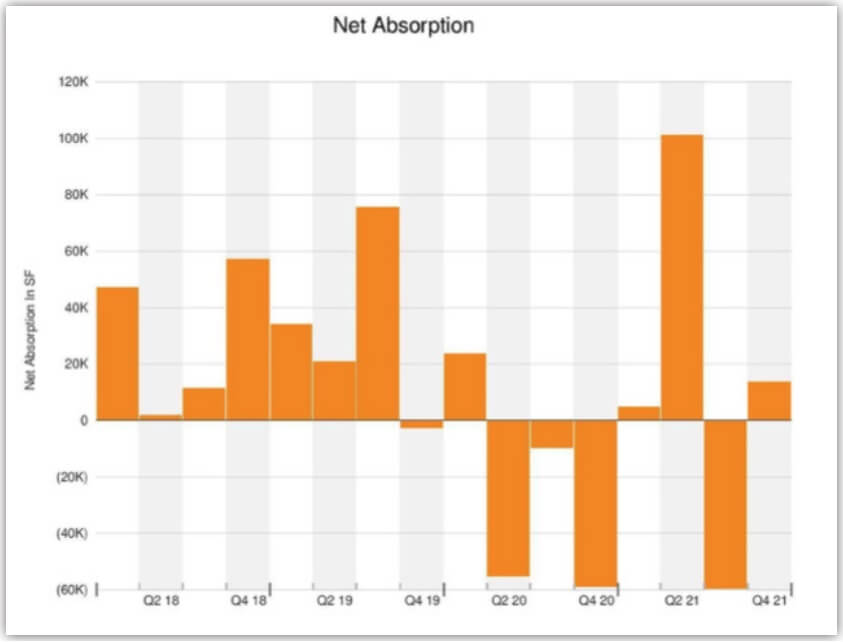

Office absorption in Salem turned sharply negative during the pandemic-induced second and third quarters of 2020. Since then, sharp swings in occupancy have been prevalent, as tenants sort out space needs heading into the post-pandemic era. In Q2, 2021, the bulk of the leasing activity and positive absorption came in the form of a single 51,096 SF lease at the 2850 Broadway NE building in north Salem along the Parkway. As schools, businesses, and other ventures transition back to some form of normal amid rapid distribution of vaccines to combat the coronavirus, the office sector looks poised to capitalize. Coupled with this fact, Salem should benefit from the lack of competition from new supply and will recover quicker than larger markets like Portland where institutional presences have been developing large speculative spaces over the past few years and vacancy hovers around 12% compared to just 4.5% here.

CONSTRUCTION

Salem has seen below-average construction levels nearly every year since the Great Recession, and the pandemic deterred most office construction projects. The last office building deliveries in the market trace back to 2018 with projects like the 27,000 SF Park Front building on Front Street, the 13,000 SF Kaiser Permanente Dental Services building at Keizer Station, and the 24,575 SF Boulder Creek South building, the home of Northbank Surgical Center. A 14,000 SF build-to-suit came online for Open Dental Software in October 2018. This was the second building to deliver on the company’s campus, with an 8,000 SF property delivered the prior year. Together, the buildings house around 150 employees.

Salem Health will finish its $245 million, seven-story, hospital expansion in 2022 which will add 150 new beds. In addition, the 35,565 SF former Northbank building was completely renovated to be a surgical center partnership between Salem Health and three local clinics.

With construction pricing at record highs, making new developments make sense financially will require full-service rents well in excess of $2.50/SF ($30/ YR).

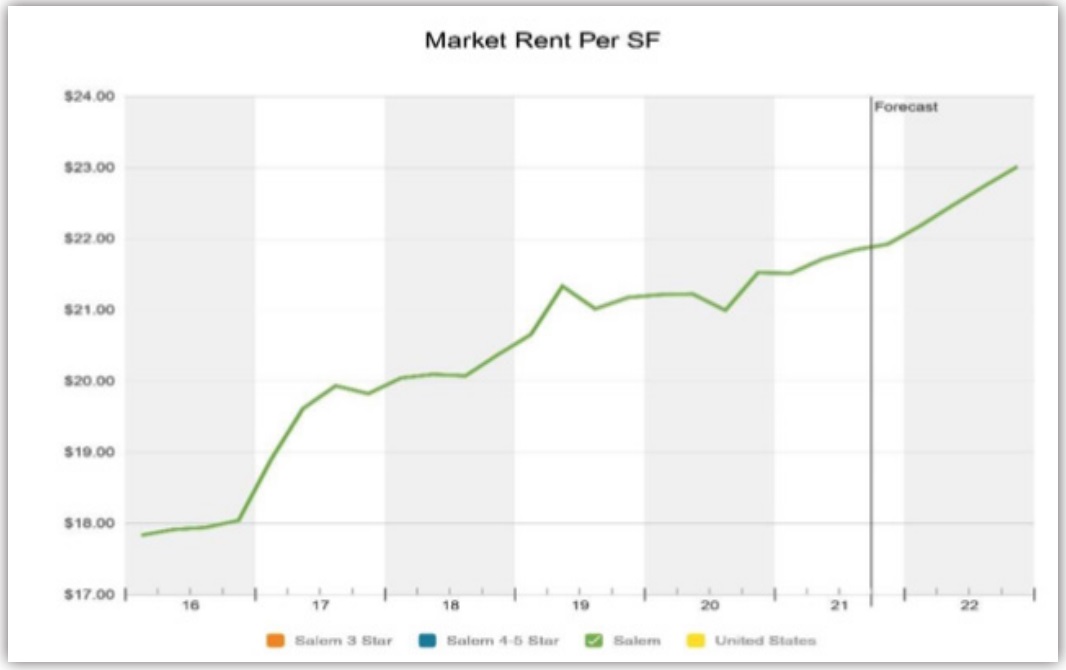

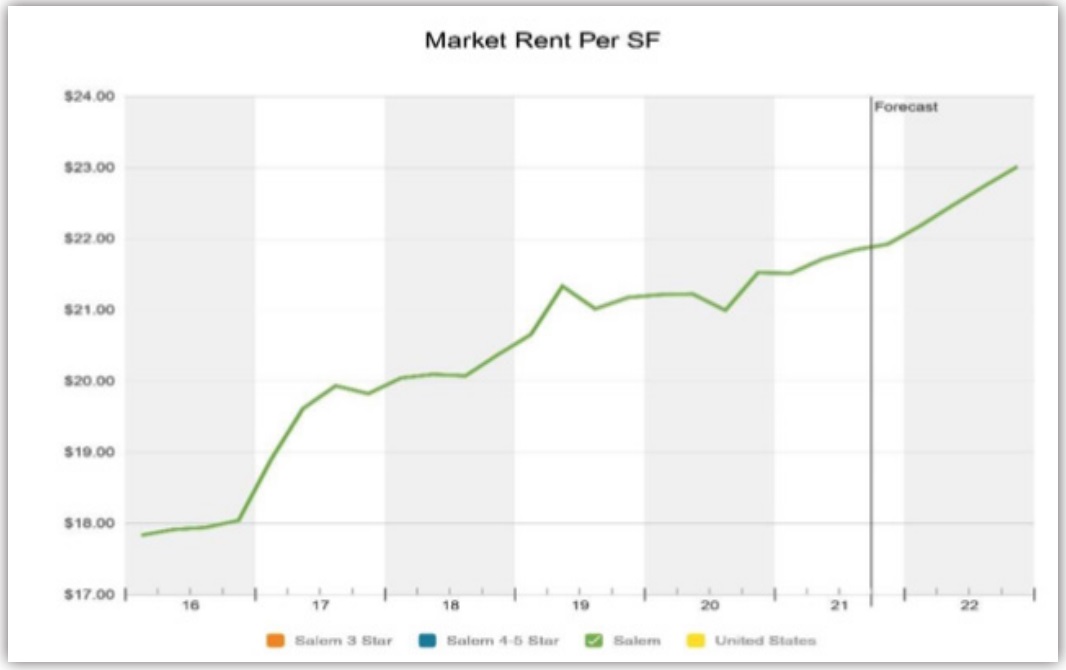

LEASING/RENTS & RENT GROWTH

A lack of competing supply and gradually improving conditions surrounding the pandemic have allowed rents to creep back up recently. Year-over-year rent growth as of the fourth quarter of 2021 was 2.3%, versus the national indexed performance of 0.0% losses. Prior to the pandemic’s onset, office rents in Salem grew by just over 3.5% in both 2019 and 2018. Average market rents only exceeded the prerecession peak in early 2018, helped along by outsized rent growth the prior year.

Influenced by the high proportion of older inventory in Salem, the overall average office rent for completed leases in 2021 was $1.82/SF, and are about 76% of Portland’s asking rent and 64% of the national asking rent of $2.86/SF. Alongside the relative age of Salem’s office assets, the lack of luxury options also weighs on rates. Salem has one 5 Star (Waterplace) and around a dozen 4 Star office buildings; there is less than 10% as much 4 & 5 Star inventory as there is 3 Star inventory.

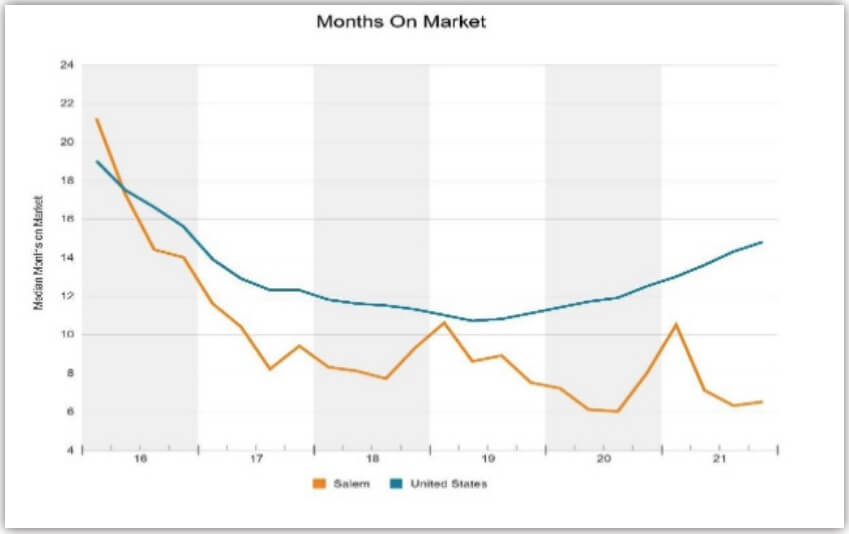

In 2021, 150 office leases were completed for 272,000 SF total compared to 131 leases for 384,000 SF in 2020. We are currently experiencing robust activity in the 1,000 to 3,000 SF range with very little product for these tenants to tour. Time on the market for an average listing continues to fall.

SALES

2021 saw the local market transact 52 office building sales for a record-setting value of more than $90.5 million compared to $62 million in 2020 and $50 million in 2019. Of note was the sale of a 34,390 SF building at 2045 Silverton Road, leased to Marion County, which sold for $17.7 million ($514/SF) and a rumored sub-6% capitalization rate. In addition, the former 54,664 SF regional center for Country Financial at 2150 Country Drive S, including a neighboring land parcel, sold for $13.2 million to WSC Building Group, LLC. The building transacted at approximately $205/SF and will be the new outpatient surgical center for Willamette Surgery Center.

The average capitalization for income properties in the market was 6.7%.

CONCLUSION

As Oregon’s state capital, virtually all of Salem’s largest office tenants are government entities. Construction levels have consistently been below the metro’s historical average throughout the post-recession era. As we progress through the Covid economy we forecast over 75% of employees will come back to an office environment. The lack of construction in the last three years will ensure strong market fundamentals in the coming years although we still expect to see companies right-sizing through 2023.