App Invests in Willamette Valley Farming

Farmland is pretty much the opposite of NFTs. There’s an actual finite supply of the stuff, it has true physical utility, and human beings quite literally need it to live.

Still, that doesn’t mean every farm is a good investment. Far from it! You should check for red flags when investing in collectibles or NFTs, and farmland is no different.

But how do you go about doing that? What should you be looking for when investing in land? What do you need to watch out for? What metrics should you prioritize?

Coming to Oregon

Literally in your backyard, the tenant farmer is a 4th generation farmer with an extensive history in the community (3,000 acres in production); the tenant identified and brought this opportunity to the company AcreTrader right inside the Willamette Valley.

Here is AcreTrader’s breakdown of what’s going on.

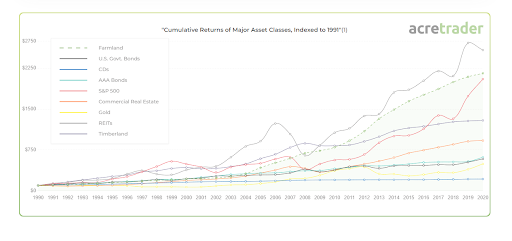

Farmland is truly one of the great underrated, hidden gem asset classes. Its returns have consistently beaten inflation and equities over the last 30 years, all while having low volatility.

These are the early days of democratized farmland investing. Until recently, investing in farmland was restricted to institutional capital and high-net-worth individuals. But the last five years have seen platforms such as AcreTrader emerge to bring this opportunity to more investors.

Institutions have not yet crowded into farmland the way they have with other real estate. For example, while shopping malls are heavily institutional owned, institutional ownership of farmland is just 1-2%.

Farmland is generally a safer investment, and AcreTrader is a great option for those considering exposure to it. The company is well-capitalized with $70m+ in funding. We’ve gotten to know the team quite well over the past few months, and trust that they are honest operators on the right path.

AcreTrader has two main competitive advantages over other farm investment apps:

- Data-driven due diligence. Their intensive due diligence process helps find the best farmland investment opportunities.

- Professional land management. They find the best deals for investors and then manage the farms to optimize returns.

|

They use geospatial data to crunch the numbers and identify the best off-market opportunities. Then they get boots on the ground (literally!) to get a first-hand view of the land. They analyze soil quality and irrigation sources to ensure that each farm is top-notch. |

All farms acquired are vetted by management, and most initial candidates don’t make the final cut. Only the best of the best are given a chance to be part of the AcreTrader portfolio.

As of May 2022, 100 farms have been offered on AcreTrader — just a fraction of the farms the AcreTrader team reviewed.

Farm management:

Farms don’t manage themselves! Finding the best managers for each farm is a big part of what AcreTrader does.

In many cases this means simply continuing the relationship with the existing owners. But if the owners want to sell and move on, AcreTrader uses their network of contacts to put a new farm management team in place.

Farm investing is all about long-term value creation. Short-term gains are not pursued at the expense of the longer-term care of the farm. Most of the AcreTrader properties have a five to a ten-year holding period, and properties are managed with this timeframe in mind.